Karl Corp Which Uses a Standard Cost Accounting System

A standard cost may be determined by past history or industry norms. Business unit receiving award of 50M or more Company together with segments receiving net awards in prior year of 50M or more.

Pdf The Importance Of Management And Cost Accounting Tools In An Organization And The Impact On Financial Performance

Companies often use standard cost accounting systems in conjunction with a process costing system.

. Unfortunately standard cost accounting methods developed about 100 years ago when. The company experiences a couple of benefits from using the two systems together. Accounting questions and answers.

In 2017 the company produced 28000 units. Uses a standard cost system to account for the costs of its one product. On January 1 2014 Job No.

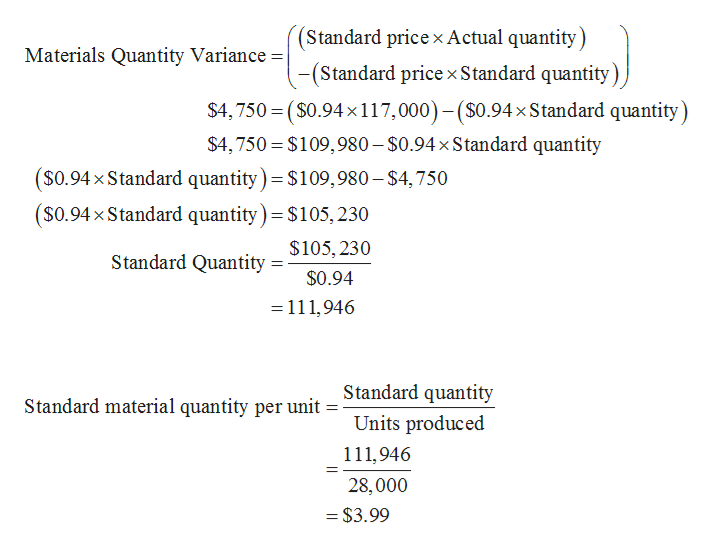

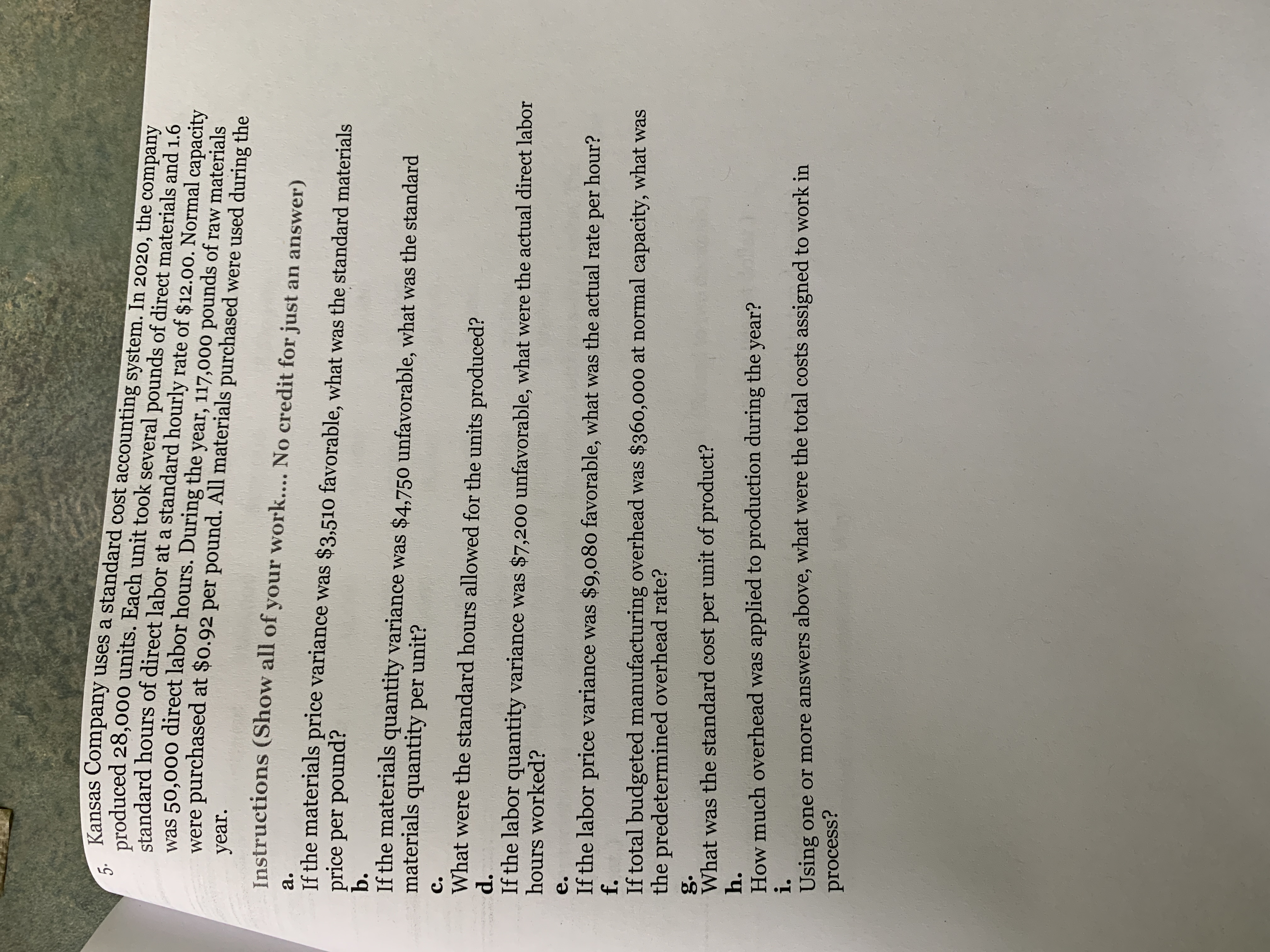

In 2014 Kansas Company uses a standard cost accounting system. Dr 10000 Interest revenue. Each unit took several pounds of direct materials and 16 standard hours of direct labor at a standard hourly rate of 1200.

Dr 15000 Loss on sale of equipment. Start studying the Cost Accounting Chapters 6-8 flashcards containing study terms like Which of the following items will be same for a flexible budget and a master budget. The purpose of standard cost accounting is to control costs and promote from ECON 102 at FEU East Asia College.

First the same accounts used to accumulate standard costs during the budget process can be used to accumulate costs during the year. Cost Accounting tandads The Institute of Cost Accountants of India Page 6 432 Standard Cost. Subsequently variances are recorded to show the difference between the expected and actual costs.

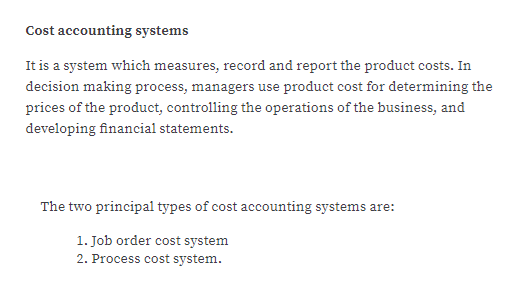

Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. During the year 130600 pounds of raw materials were purchased at 090 per pound. Describe the role of the modern management accountant and the CAS in cost manage-ment.

Total fixed costs c. 9903202-9 Standard form submitted for segments and home office units DS Form CASB DS-1 Who must file. Some costs are prime cost direct cost factory cost selling cost etc.

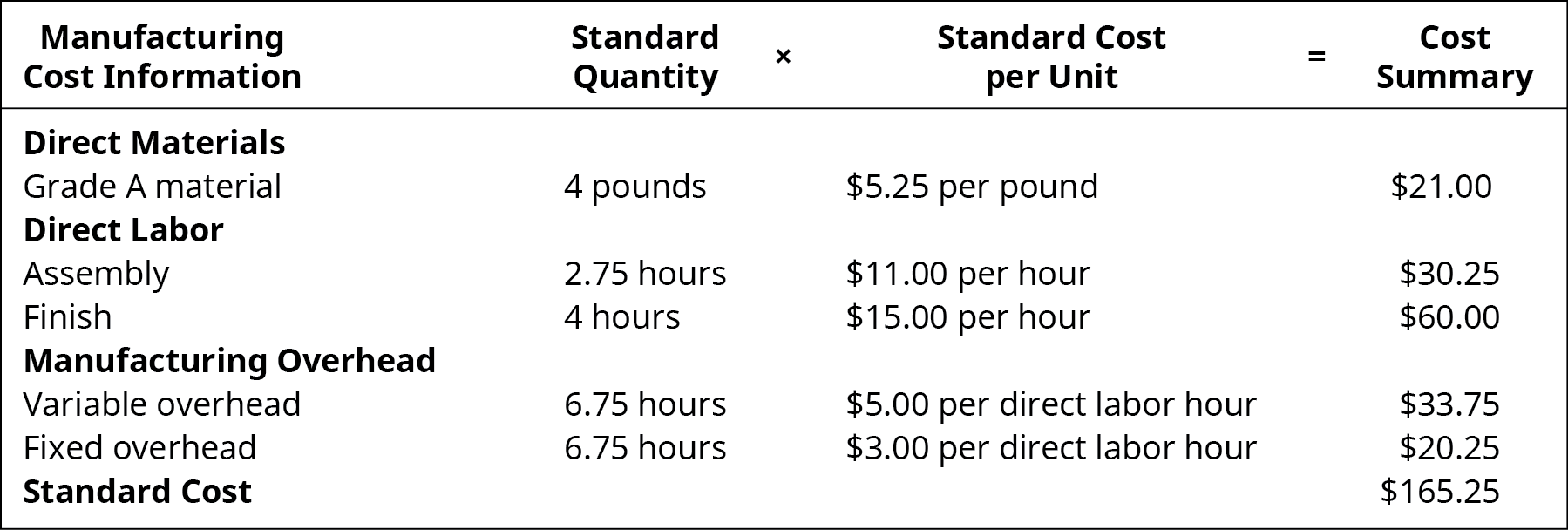

The standard cost is an expected amount paid for materials costs or labor rates. Total revenues Standard material cost per kg of. This approach represents a simplified alternative to cost layering systems such as the FIFO and LIFO methods where large amounts of historical cost.

Setting Standards LEARNING OBJECTIVES After studying this chapter you should be able to. A predetermined cost of a product or service based on technical specifications and efficient operating conditions. The standard quantity is the expected usage amount of materials or labor.

Standard cost accounting uses ratios called efficiencies that compare the labor and materials actually used to produce a good with those that the same goods would have required under standard conditions. Each unit took several pounds of direct materials and 16 standard hours of direct labor at a standard hourly rate of 1100. In 2014 the company produced 28000 units.

Cr 150000 Cost of sales. Standard costs are used as scale of reference to compare the actual cost with the standard cost with a view to determine the variances. Memorize flashcards and build a practice test to quiz yourself before your exam.

It also helps in calculating efficiency. The following information pertains to direct labor for model 209 for the month of June. For example it is the cost accounting system used by oil refineries chemical producers etc.

Manufactures GPS devices and uses a standard cost system. A written summary of a contractors cost accounting practices set forth at 48 CFR. Total contribution margin d.

Cost Accounting Standards popularly known as CAS are a set of 19 standards and rules promulgated by the United States Government for use in determining costs on negotiated procurements. Actual rate paid 12 per hour Standard rate 1050 per hour Standard hours allowed for actual production 3880 hours Labor efficiency variance 735 favorable What. Process costing is a cost accounting system that accumulates manufacturing costs separately for each process.

During November Branch Corp. The company can then compare the standard costs against its actual results to measure its efficiency. It is appropriate for products whose production is a process involving different departments and costs flow from one department to another.

Dr 9000 Commissions to salespersons. Normal capacity was 50000 direct labor hours. Define the components of a standard cost card and list its benefits for cost manage-ment.

Variable overhead is applied using direct labor hours. Standards allowed for each unit are 28 hours of labor at a variable overhead rate of 12. As long as actual and standard conditions are similar few problems arise.

Cost Accounting is a system of foresight and not a postmortem examination it turns losses into profits speeds up activities and eliminate wastes. The Standard Cost Accounting System Part I. Problem 11-4A Kansas Company uses a standard cost accounting system.

Payroll totaled 97790 for 7150 hours worked. Dr 60000 Administrative expenses. CAS differs from the Federal Acquisition Regulation FAR in that FAR applies to substantially all contractors whereas CAS applies primarily to the larger ones.

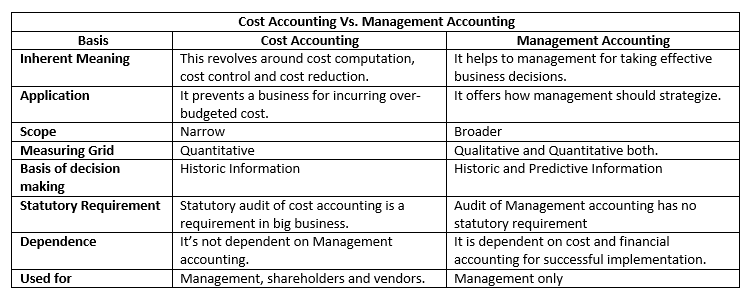

Cost accounting is a Management Information System which analyses past present and future data to provide the basis for managerial decision making. Cost Accounting Standard 406 - Cost Accounting Period 8-4061 General 8-4062 Restructuring Costs 8-407 Cost Accounting Standard 407 - Use of Standard Costs for Direct Material and Direct Labor 8-4071 General 8-4072 Illustrations 8-408 Cost Accounting Standard 408 - Accounting for Costs of Compensated Personal Absence 8-4081 General. Cost Accounting Standard CAS 9905502 states All costs incurred for the same purpose in like circumstances are either direct costs only can be charged to a grant or indirect costs only must be paid with unrestricted funds with respect to final cost objectives Uniform Guidance 2 CFR 200 then goes on to list specific costs that the federal government considers to be normally.

Karl Corps trial balance of income statement accounts for the year ended December 31 Year 1 included the following. Cost accounting is the internal process of collecting organizing and analyzing financial data from within a company and advising management on the most cost efficient course of action. Such classification allows the management to control the costs and ascertain the profitability of any such processes and activities.

Normal capacity was 50300 direct labor hours. Degelman Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. Total variable cost b.

Cost accounting involves the recording and classification of such costs.

Answered A Name Two Principal Types Of Cost Bartleby

Answered Kansas Company Uses A Standard Cost Bartleby

Pdf How Do German Companies Run Their Cost Accounting Systems

Answered Kansas Company Uses A Standard Cost Bartleby

Making Better Decisions By Applying Mathematical Optimization To Cost Accounting An Advanced Approach To Multi Level Contribution Margin Accounting Sciencedirect

Making Better Decisions By Applying Mathematical Optimization To Cost Accounting An Advanced Approach To Multi Level Contribution Margin Accounting Sciencedirect

Access Database Small Business Accounting Cashbook Templates Access Database Small Business Accounting Business Template

Iso 31000 2018 Risk Management Programme Management Infographic Corporate Risk Management Business Process Management

Answered Kansas Company Uses A Standard Cost Bartleby

Answered Distinguish Between Cost Accounting And Bartleby

Pdf Cost Accounting Information Use For Product Mix Design

Smartoffice Automated Accounts Payable From Db Computer Solutions Solutions Accounts Payable Increase Productivity

Explain How And Why A Standard Cost Is Developed Principles Of Accounting Volume 2 Managerial Accounting

Making Better Decisions By Applying Mathematical Optimization To Cost Accounting An Advanced Approach To Multi Level Contribution Margin Accounting Sciencedirect

Explain How And Why A Standard Cost Is Developed Principles Of Accounting Volume 2 Managerial Accounting

Monthly Income Statement Monthly Income Statement Template Income Statement Statement Template Profit And Loss Statement

Pdf How Do German Companies Run Their Cost Accounting Systems

Comments

Post a Comment